San Tan Valley’s Preferred Life Insurance Insurance Agency

Each of our experienced San Tan Valley life insurance brokers specialize in crafting life insurance plans that align with individual goals. With a reputation for reliability and transparency, we guide our clients through the intricacies of life insurance, ensuring they have all the options in front of them in order to make well-informed decisions. By offering a diverse range of policies, from term to permanent life insurance, we cater to the diverse needs of our clients, providing them with peace of mind and financial security. At our agency, customer satisfaction is our priority, and we strive to build lasting relationships based on trust and reliability. Whether you are a family looking to protect your loved ones or a business aiming to secure its future, we are the preferred choice for comprehensive life insurance solutions in San Tan Valley.

Secure Your Future With Confidence: Expert Advice On Life Insurance Policies

Secure your future with confidence by seeking expert advice on life insurance policies. Our seasoned professionals offer tailored guidance to help you navigate the complexities of life insurance, ensuring you make informed decisions aligned with your financial goals. Whether you’re considering term, whole life, or specialized policies, our experts provide comprehensive insights into each option, empowering you to choose the coverage that best suits your needs. We prioritize you and your family or business, providing you with the confidence to face the future with assurance. Trust our expertise to guide you towards a life insurance policy that safeguards your loved ones and secures your financial legacy.

The Advantages Of Getting A Life Insurance Policy Through Our Agents

Discover The Right Life Insurance Plan For San Tan Valley Residents

Term Life Insurance

Term life insurance is a type of life insurance that provides coverage for a specified period, known as the term, typically ranging from 10 to 30 years. If the policyholder dies during the term, the death benefit is paid out to the beneficiaries tax-free. Unlike permanent life insurance, term life insurance does not accumulate cash value, making it a more affordable option for individuals seeking straightforward coverage for a specific period.

Whole Life Insurance

Whole life insurance is a type of permanent life insurance that provides coverage for the entire lifetime of the policyholder. It combines a death benefit with a cash value component that grows over time, offering a tax-advantaged savings element. Whole life insurance premiums remain level throughout the policyholder’s life, providing a predictable cost and long-term financial protection.

Universal Life Insurance

Universal life insurance is a type of flexible permanent life insurance that combines a death benefit with an investment component. Policyholders have the flexibility to adjust their premium payments and death benefits, and the cash value of the policy can earn interest over time, often at rates that are tied to market performance. Universal life insurance is suitable for individuals seeking both life insurance coverage and the potential for cash value growth.

Variable Universal Life Insurance

Variable Universal Life Insurance is a type of permanent life insurance that combines the flexibility of universal life with investment options. Policyholders can allocate their premiums among various investment accounts, typically mutual funds, and the cash value and death benefit vary based on the performance of these investments. This provides the potential for cash value growth, but it also comes with risks, as the returns are tied to the market.

Why We’re San Tan Valley’s Most Reliable Life Insurance Agents

We pride ourselves on a combination of experience, dedication, and personalized service that sets us apart from the rest. Our team understands the unique needs of the community, and we are committed to providing tailored life insurance solutions that cater to the diverse requirements of individuals and businesses in the area. With a wealth of knowledge and a deep understanding of the insurance landscape, we guide our clients through the complexities of life insurance, ensuring they make informed decisions that align with their financial goals.

We prioritize transparency in our interactions, making sure our clients fully comprehend their policy terms, coverage options, and associated benefits. Our commitment to excellence extends beyond mere transactions; we are invested in building long-lasting relationships with our clients, fostering a sense of trust and reliability. Leveraging our extensive network of top-rated insurance providers, we have the flexibility to offer a wide array of coverage options, ensuring our clients have access to the best policies available in the market.

Whether you are a family seeking comprehensive coverage or a business looking to protect its assets and key personnel, our team of reliable agents is dedicated to meeting your unique needs.

Top Life Insurance Brokers Serving San Tan Valley Families & Businesses

In the vibrant community of San Tan Valley, our team of top-tier insurance brokers is dedicated to providing unparalleled service for both families and businesses. At Phoenix Health and Life Insurance, we understand that protecting your loved ones or ensuring the continuity of your business is of utmost importance. With a commitment to excellence, our experienced brokers take the time to understand your unique needs and financial goals, offering personalized life insurance solutions tailored to your specific circumstances.

Our extensive network of top-rated insurance providers allows us to present you with a diverse range of coverage options, ensuring that you have access to the best policies at competitive rates. Whether you’re seeking term life insurance for short-term needs or permanent life insurance for long-term financial planning, our brokers have the expertise to guide you through the process. We pride ourselves on transparency, ensuring that you fully comprehend your policy terms and the benefits it provides.

With a focus on building lasting relationships, our brokers are here to support you every step of the way, making the process of obtaining life insurance a seamless and empowering experience for San Tan Valley families and businesses alike. Trust us to safeguard what matters most to you.

Estimate Your Life Insurance Need

Use our calculator and get a free estimate

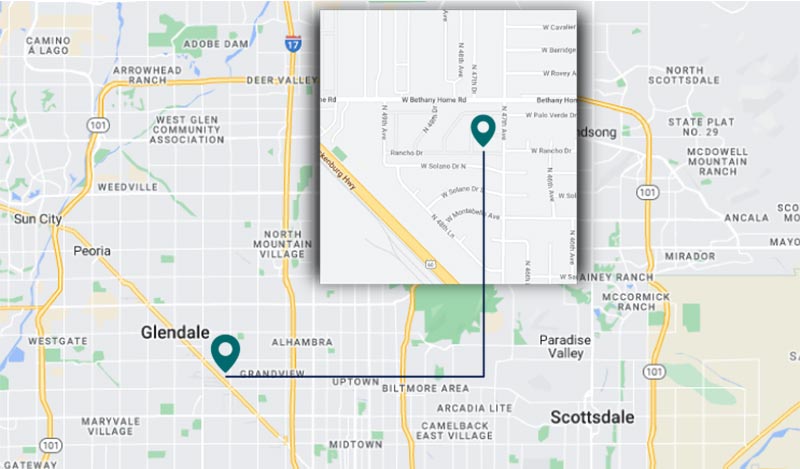

Visit Our Life Insurance Company Near San Tan Valley