Buckeye’s Preferred Health Insurance Plans

Discover Buckeye’s preferred health insurance plans, offering a comprehensive range of options tailored to meet the diverse needs of our community. Our plans are designed with your health and well-being in mind, providing coverage for a variety of medical services, ensuring peace of mind for you and your family. Whether you’re looking for individual coverage, family plans, or group options, our selection is curated to offer the best in health care protection.

In Buckeye, we understand the importance of reliable health insurance. That’s why our plans are backed by exceptional customer service and support, guiding you through the selection process to find the perfect fit for your health care needs. With our flexible and affordable options, you can enjoy access to a wide network of healthcare providers, ensuring quality care at your fingertips. Choose Buckeye’s leading health insurance to safeguard your health, ensuring you and your loved ones have the coverage you deserve.

Reliable Health Insurance Near Buckeye

Find reliable health insurance close to Buckeye, offering comprehensive coverage tailored to your needs. Our plans ensure accessibility to a broad network of healthcare providers, delivering peace of mind with quality care and exceptional service, making sure you’re protected wherever life takes you in the Buckeye area.

Experienced Life Insurance Agents Near Buckeye

In Buckeye, our experienced life insurance agents are dedicated to providing personalized service, ensuring you find the right policy to secure your family’s future. With expertise in various life insurance options, our agents guide you through choosing coverage that aligns with your goals, offering peace of mind and financial stability.

Cost-Effective Medicare Coverage Options Near Buckeye

Explore our cost-effective Medicare coverage options near Buckeye, designed to provide comprehensive healthcare without straining your budget. We offer a variety of plans to meet your medical needs, ensuring access to quality care and services. Let our experts near Buckeye assist you in finding a Medicare plan that offers the best value and peace of mind for your healthcare journey.

Most Trusted Individual & Family Health Insurance Agency Near You

More Coverage & Lower Rates

Our agency offers exceptional individual and family health insurance with more coverage at lower rates. Choose us for affordable, comprehensive protection tailored to your needs, ensuring peace of mind and financial ease.

Customized Plans & Service

Our agency specializes in offering customized plans and personalized service to meet your specific health insurance needs. We understand that each individual and family is unique, so we tailor our plans to fit your lifestyle and budget, ensuring you receive the coverage that’s right for you.

Complete 100% Online

Our entire process is streamlined to be completed 100% online, offering you the convenience of selecting, customizing, and managing your health insurance plan from anywhere. This digital approach ensures a seamless, efficient, and user-friendly experience, allowing you to secure your health coverage with just a few clicks.

No Paperwork Needed

Our service eliminates the hassle of traditional paperwork. With our streamlined digital process, you can manage all aspects of your health insurance without the need for physical documents. This not only simplifies the procedure but also contributes to a greener planet by reducing paper use.

Benefits Of Purchasing Health Insurance For You & Your Family

Insurance Choices For Unexpected Healthcare Costs

Providing Comprehensive Healthcare Coverage

Early Detection & Disease Control

Ensuring Financial Stability During Health Challenges

Legal Obligations in Various Jurisdictions

Inclusive Mental Health Services: Therapy, Counseling, & Medication

Buckeye Level Funded Health Insurance / Return Of Premium Health Insurance

Predictable Monthly Costs: Level-funded health insurance ensures consistent monthly premium payments.

Potential Refunds for Low Claims: Businesses may get back part of their premiums if claims are low.

Stability in Premiums with Refund Opportunities: Employees enjoy consistent premiums with the possibility of receiving refunds.

Promoting Healthier Lifestyles: Premium refunds encourage healthy behaviors, offering financial rewards.

Customizable Insurance Options: Coverage can be adjusted to meet the unique needs of both the business and its employees.

Financial Oversight on Healthcare Expenses: Level-funded plans give businesses control over their healthcare spending.

Our Coverage Encompasses A Broad Selection Of Health Insurance Providers

Our coverage stands out for its wide-ranging selection of health insurance providers, ensuring that you have access to an extensive array of options. This diversity allows us to cater to varied health needs and preferences, offering plans that encompass different levels of coverage, deductibles, and premium options. Whether you’re looking for basic coverage or a more comprehensive plan, our network includes providers known for their reliability and quality of service. We’re committed to guiding you through the selection process, helping you compare and choose the plan that best fits your lifestyle and budget. With our broad selection, you can feel confident in finding a health insurance solution that provides the protection you need and the peace of mind you deserve.

Health Insurance Plans For Buckeye Homes & Businesses

Safeguard Your Employees’ Health with Insurance Coverage

Discover our specialized health insurance plans designed for homes and businesses in Buckeye. These plans are tailored to safeguard the health of your employees, providing comprehensive coverage that ensures their well-being and peace of mind. With a focus on affordability and flexibility, our insurance solutions cater to various needs, allowing businesses of all sizes to offer their employees the protection they deserve. Embrace a healthier future for your team with our reliable insurance coverage, enhancing productivity and employee satisfaction by prioritizing their health and security. Choose our health insurance plans and invest in a healthier, more secure future for your Buckeye home or business.

Buckeye’s Most Reliable Insurance Products & Services

Our Expertise Lies In the Following Areas

New IRS Rules for Employers Regarding Health Insurance

Within the past year, the IRS posed a question to themselves to consider imposing more specific rules and guidelines to employers. These rules were in regard to the effect of employers’ decisions to contribute to employees choosing alternate healthcare coverage.

What are the consequences to the employer if the employer does not establish a health insurance plan for its own employees, but reimburses those employees for premiums they pay for health insurance (either through a qualified health plan in the marketplace or outside the marketplace)?

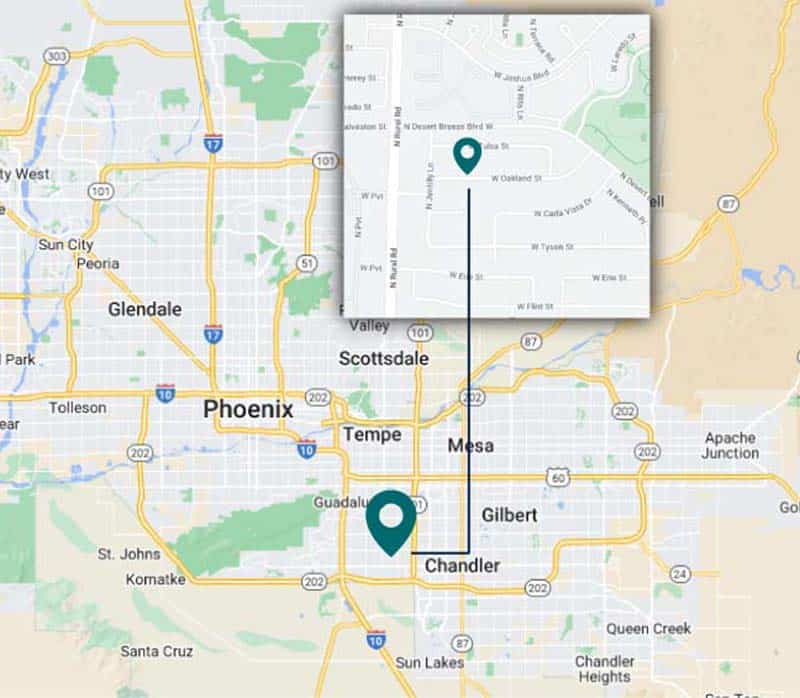

Visit Our Health Insurance Agency’s Office

PROUD SPONSORS OF: