The Most Reliable Life Insurance Insurance Company Near Arrowhead

Phoenix Health and Life Insurance is renowned for reliability. Our company has earned a stellar reputation by consistently delivering top-notch customer satisfaction and financial stability. Tailoring comprehensive life insurance policies to meet diverse needs, we provide transparent coverage options with competitive premiums. At Phoenix Health and Life Insurance, we prioritize your security, offering trustworthy policies backed by a commitment to fair and prompt claims processing. Join the community in Arrowhead who confidently rely on our skilled insurance agents for dependable coverage. Choose us for unparalleled service, unmatched reliability, and the assurance that your loved ones are in the safest of hands. Contact us today for a pressure-free consultation!

Get Expert Advice On Choosing The Right Life Insurance Policy For You

Navigating the complexities of life insurance can be overwhelming and confusing. If you’re someone trying to figure it out on your own, seek our expert advice to ensure you choose the right policy for your unique needs. Our experienced professionals can guide you through the intricacies of coverage options, helping you understand the nuances that align with your financial goals. They assess factors such as your age, health, and financial situation to tailor a policy that provides optimal protection. When you seek our expert advice, you will be empowered to make informed decisions, whether you’re considering term life, whole life, or universal life insurance.

Benefits Of Getting A Life Insurance Policy With Our Agents

Types Of Life Insurance Plans We Provide For Arrowhead Residents

Term Life Insurance

Term Life Insurance provides coverage for a specific period. It is designed to provide a death benefit to the beneficiaries if the insured person passes away during the term of the policy. The premiums are typically lower compared to permanent policies and no cash value is accumulated. It is a great way to obtain life insurance for a specific duration.

Whole Life Insurance

Whole Life Insurance is a traditional life insurance policy that provides coverage for the entire lifetime of the insured, as long as the premiums are paid. Once the policy holder passes away, the beneficiaries will receive a death benefit. Along with the death benefit, whole life insurance policies also have a cash value component that accumulates overtime.

Universal Life Insurance

Universal Life Insurance is another permanent life insurance that combines a death benefit with a savings or investment component. Like Whole Life Insurance, it provides coverage for a lifetime, as long as the premiums are paid. However, universal life insurance offers greater flexibility in terms of premiums, death benefits, and the investment component.

Variable Universal Life Insurance

Variable Life Insurance is a type of permanent life insurance that combines a death benefit with an investment component. It shares similarities with both whole life insurance and universal life insurance, but has distinct characteristics, particularly in terms of the investment aspect. It is more suitable for individuals who are comfortable taking on investment risk.

Why We’re Arrowhead’s

Preferred Life Insurance Agents

As Arrowhead’s preferred life insurance agents, we have become known through a commitment to personalized service and expertise in meeting the unique needs of our community. We understand the local dynamics, ensuring that our clients receive solutions that resonate with their specific circumstances. We pride ourselves on transparency, providing clear and comprehensive information about life insurance options, terms and benefits. We offer a range of coverage options that cater to various financial goals and family structures.

Our dedication to accessibility means that clients can easily reach out for consultations, making the process of securing life insurance both seamless and convenient. We prioritize building long-term relationships, striving to be more than just agents but trusted partners in our client’s financial journeys. By consistently delivering reliable, cost-effective, and innovative life insurance solutions, we have earned the trust and preference of the Arrowhead community. Choose us for a personalized approach to life insurance that puts your needs and peace of mind at the forefront.

Best-Rated Life Insurance Brokers Serving Arrowhead Families & Businesses

Our commitment to providing exceptional service to both families and businesses sets us apart as trusted advisors. With top ratings, we have garnered recognition for our dedication to customer satisfaction, reflecting the positive experiences of those we’ve served. Our team specializes in tailoring life insurance solutions that address the unique needs of Arrowhead residents, ensuring comprehensive coverage for both families and businesses alike.

We prioritize clarity and transparency, guiding our clients through the intricacies of life insurance policies with a clear understanding of terms and benefits. Recognizing the diverse dynamics of Arrowhead, our brokers offer a wide array of coverage options to accommodate various financial objectives. Whether you’re seeking protection for your family or business, our best-rated brokers bring a wealth of expertise to help you make informed decisions.

We are proud to be the preferred choice for life insurance services in Arrowhead, committed to upholding our reputation as the best in the business. Choose us for unparalleled service and a commitment to securing the futures of Arrowhead families and businesses. Contact us today to get started on your consultation!

Estimate Your Life Insurance Need

Use our calculator and get a free estimate

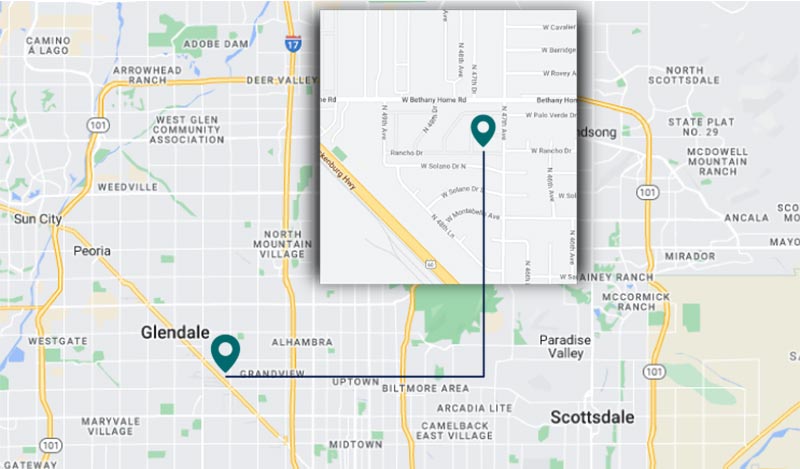

Visit Our Life Insurance Company Near Arrowhead