Best-Rated Health Insurance Plans For San Tan Valley Residents

Phoenix Health & Life Insurance is recognized as one of the Valley’s leading health insurance agencies. We have access to a wide variety of insurance options and can help you find the health insurance you’re looking for at an affordable price. Health insurance doesn’t have to be overwhelming! Our San Tan Valley health insurance agents will explain your options in a way that you can understand, so you know exactly what you’re getting and what will be covered. Let us protect your family and future with an affordable health insurance plan. Call us now to get started!

Cost-Effective Health Insurance Plans

Although many people are worried about the cost of San Tan Valley health insurance, we can help you find an affordable health insurance plan that covers the services you need. Don’t risk overwhelming medical bills when you can find a cost-effective health insurance plan with our agents.

Comprehensive Life Insurance Policies

Protect your family’s future and financial stability when you work with our San Tan Valley life insurance agents to find a policy that fits your lifestyle. We offer multiple life insurance types and are confident that one of our plans will be exactly what you’re looking for!

Medicare Policies & Supplement Plans

Medicare can be confusing, but our trusted San Tan Valley health insurance agents can help. We will help you understand your available options, explore any potential gaps in your coverage, and work with you to discover supplement policies that can ensure your needs are covered.

Top Choice Individual & Family Health Insurance Agency Near You

More Coverage & Lower Rates

Phoenix Health & Life Insurance is proud to be a leading health insurance agency in Arizona. With access to many different plans, we specialize in helping individuals, businesses, and families find health insurance policies that provide the coverage they need at an affordable price.

Personalized Plans & Service

Our San Tan Valley health insurance agents will listen closely to your needs and goals, then help you find the plans that will be the best fit for you. Our personalized approach to customer service is one of the top reasons why our agency consistently receives five star reviews.

Complete 100% Online

Use our online dashboard to explore your options and finalize all of the details. We can even meet with you through video call in the convenience and comfort of your own home. Reach out to Phoenix Health & Life Insurance today to learn more about how we can serve you.

No Paperwork Required

When you work with our San Tan Valley health insurance agency, you won’t need to waste time dealing with stacks of paperwork or tracking down employees to sign forms. Everything can be conveniently managed through our secure online portal. We’ll handle all the details!

Read Our Clients’ Testimonials

5-Star Rated Health Insurance Near San Tan Valley

Benefits Of Buying Health Insurance For You & Your Family

Affordable Coverage To Help You Pay For Unexpected Medical Expenses

Ensure Access To Quality Healthcare Services

Early Prevention & Detection Of Health Issues

Financial Protection Against Unforeseen Health Issues

Mandatory In Numerous Countries As Per Legal Requirements

Inclusive Coverage For Mental Health Services, Including Therapy & Counseling

Level Funded & Return Of Premium Insurance Solutions For Employers In San Tan Valley

Federal regulations for employer insurance options change frequently, but we can help your Arizona business maintain legal compliance while saving you money! One way that we can do this is by offering level funded insurance options. These types of plans offer many advantages to business owners and their employees with affordable and consistent monthly payments. Return of premium life insurance policies are another way that your company may be able to save money in the long run. Call one of our trusted San Tan Valley employer insurance agents today to learn more.

We Work With A Wide Variety Of Health Insurance Carriers

To keep our costs competitive and to ensure access to the largest number of leading healthcare providers, clinics, hospitals, and services, Phoenix Health & Life Insurance works with nationally recognized health insurance carriers, along with other popular models, such as health sharing ministries. Whether you’re an individual, business, or family who is seeking health insurance coverage, we have the perfect health insurance plan to meet your needs.

Health Insurance Plans For San Tan Valley Families & Business Owners

Obtain Insurance Coverage For Your Company’s Employees

According to federal law, businesses with over 50 employees are required to provide a health insurance plan for their employees or face fines. Although smaller companies are not required to provide a health insurance option, offering insurance plans to your employees can dramatically boost your benefits package and increase your appeal to potential employees. Let us help your business maintain legal compliance or increase your ability to retain employees by showing you how affordable it can be to offer a quality San Tan Valley health insurance plan to your employees. Reach out to us today!

Trusted Health Insurance Agency Near San Tan Valley

Types Of Health Insurance Policies We Specialize In

New IRS rules for employers regarding health insurance

Employers are subject to IRS policies and federal laws regarding health insurance coverage and options that can have a dramatic impact on your company’s taxes. When you reach out to one of our trusted agents, we can help you understand how the Affordable Care Act (ACA), IRS regulations, and other federal laws and guidelines apply to your business, as well as what options you may have and how to determine which health insurance options may be the best choice for your business. We can simplify the process and guide you in the best decision for your company. Call us today!

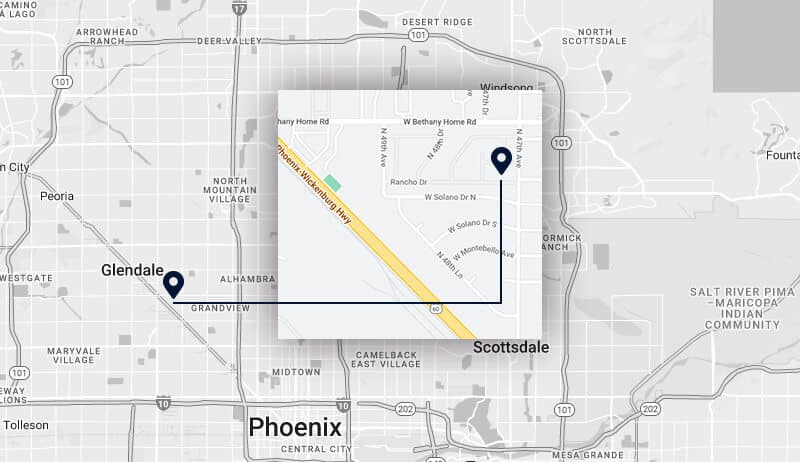

Visit Our Health Insurance Agency’s Office

PROUD SPONSORS OF: